The Masters begins today. It is a rite of spring for the sporting public. There are but a handful of sponsors of this august golfing event – five to be specific – of which only three are Global Sponsors. IBM is one of those, alongside AT&T and Mercedes Benz.

However, IBM enters this year’s tourney with a string of advertising bogeys. It is so bad, in fact, that it ended up on the wrong side of the ledger in our annual BLACKBOOK ranking of the Movers & Shakers from 2013.

IBM suffered the largest fall of any advertiser among 200+ brands that aired more than five unique new ads in 2013. Its decline of 17% is precipitous to be sure, but the deeper question is why?

Well, in typical Big Blue fashion, the answer can be found in the data. The reason for the decline is fundamentally driven by ad length. In 2013, IBM introduced 12 new ads – most of them for Watson and most of them in a :15 format.

The problem is that IBM is trying to do too much in too little time and the results are disastrous. Not a single ad from IBM broke 500 in 2013, yet, in the past, this is a brand that routinely posted high 500s and low 600s. How could this happen?

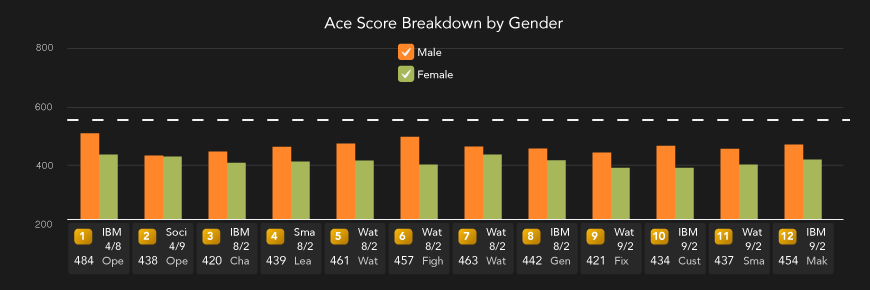

First off, it lost women entirely:

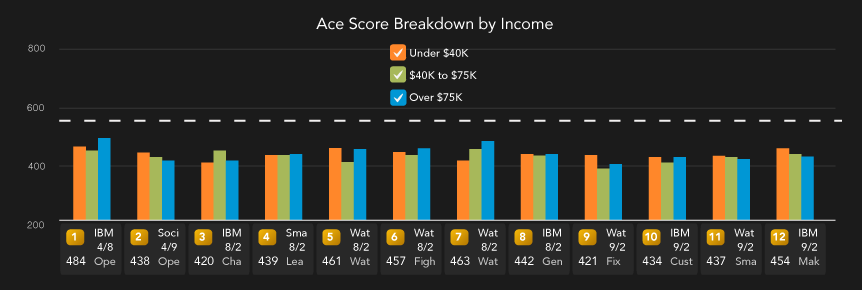

Second, it didn’t win with its core demo, high income consumers. IBM’s offerings in 2013 showed no material benefit from consumers who earn over $75K. In fact, in 7 of the 12 ads, consumers who earn under $40K scored the ad highest. This is further underscored when we ran these ads against an augmented audience of $75K+ earners.

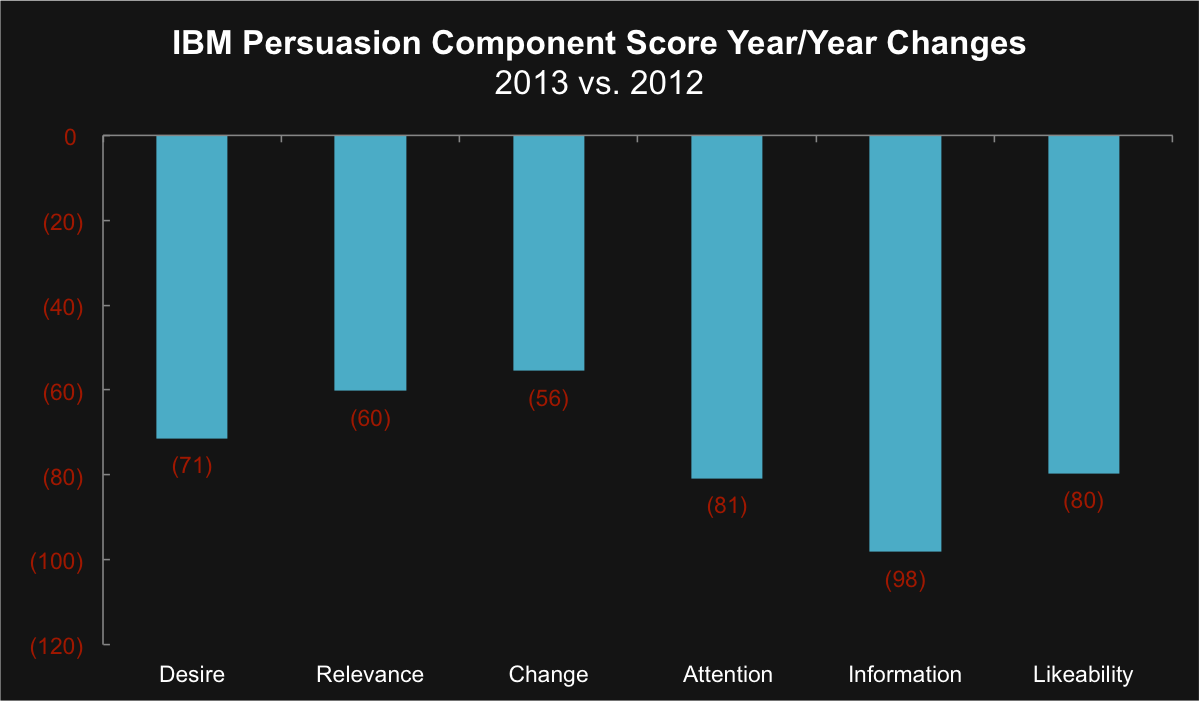

Third, it failed to connect the purpose of Watson with stories that are relatable or informative. The ads were simply too short to impart information effectively, although to watch them you would suspect the goal was to inform; yet the ads didn’t. Information fell 16% from 2012 to 2013. This is entirely consistent with our other research around ad length. Also consistent with that research is IBM’s relevance score. It too is down, but only 10%. On an overall basis, Relevance and Desire are the least impacted of the components when it comes to length.

There are certainly ways out of this mess. One is to pre-test the creative until you get it right. The second is to take a hard look at the media plan and determine if the audience IBM is buying (primarily US Open and the Masters) is a fit for the advertising it is running or if it’s more aspirational in nature. I suspect the argument is that IBM’s audience is highly targeted. But, as we saw above, the data doesn’t support that from an income perspective and once you start targeting beyond that, you are wasting 75% of your spend on an audience that thinks your ads aren’t any good.

Is there a silver lining here? Perhaps… IBM spent most of its money in 2013 supporting creative from 2012. Perhaps Watson knew too…